The release of FAPBM’s Impact Investing 2021 Report provides an opportunity to interview one of our experts: the Investment Committee President, Mr. James Ranaivoson, a member of the FAPBM Board of Trustees since 2019. Mr. Ranaivoson is a former advisor to the European Investment Bank’s (EIB) Private Equity, New Products & Special Transactions department. He currently works as a Financial advisor in Luxembourg as founder and managing partner of WINDOF CAPITAL. He is also a member of Graines de vie Board, Luxembourg, an active NGO in reforestationprograms in Madagascar.

Q: Could you explain impact investing?

A: In 2022, FAPBM was able to finance around 30% of the total costs of 48 protected areas in Madagascar, covering more than 3.6 million hectares of Malagasy forests and coastal areas for the benefit of 3.5 million people. This funding comes primarily from FAPBM’s capital revenues.

Some donors prefer to contribute to the capital of FAPBM so that their donations generate sustainable revenues, rather than directly and one-time providing funding to a conservation project in the protected areas.

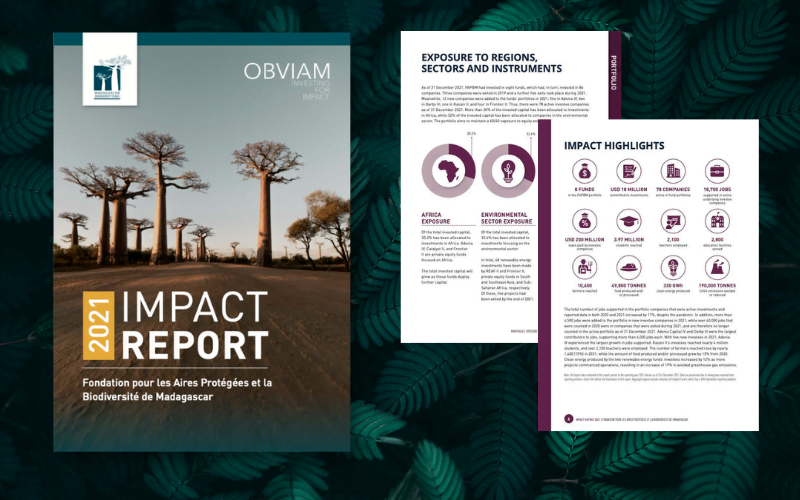

Capital revenues are used by FAPBM to sustainably finance the recurrent costs essential to the management of protected areas. 20% of FAPBM’s capital is used for impact investing, i.e. in projects that generate not only some level of financial return but -importantly- with a direct social or environmental impact.

Q: Why support impact investing?

A: While FAPBM’s grants support protected area managers in their work to maintain ecosystem services, FAPBM strives for its capital investments to support positive impacts as well. For example, our capital is invested in projects that enable entrepreneurial initiatives in favor of health, the environment and education access to finance, with a particular focus in countries on Asia and Africa. FAPBM also keeps in mind its profitability objectives and limits exposure to high-risks investments so that FAPBM’s commitments to protected areas can be kept.

In 2021, for example, investments supported 78 companies engaged in sustainable health, renewable energy,education or agriculture and generated an average return of 6.84%.

Q: An example of impact investing?

A: Capital was invested in AFRICA BIOSYSTEMS LIMITED (ABL), a Kenya-based distributor of healthcare and clinical diagnostic equipment and consumables. Molecular testing platforms and screening & diagnostic centers inEast Africa are critical for physicians to appropriate treatment plans.

During the COVID-19 pandemic, ABL played a significant part in facilitating screening through the distribution, installation, and training of laboratory technicians in East African laboratories. ABL’s activities have had definitepositive impact in reducing the impacts of the viruses.

FAPBM funding will support key activities required for ABL’s growth, including the launch of the demonstration laboratory, which will also serve as a training center for practitioners and students in the region. ABL also plans toestablish a warehouse to store fast- moving materials and consumables and reduce delivery times.

When will impact investing be introduced in Madagascar?

Madagascar already has many examples of successful impact investing. However, the Malagasy context to impact investing remains complex and the high standard of FAPBM’s accountability require extreme caution and more in-depth knowledge. The investment committee and executive management have begun discussions on the necessaryconditions to apply responsible impact investment in the country.